Therefore, you might think you have more available funds than you actually do. The check could also take a while to appear in your bank statement or to clear. For example, this could happen when you give someone a check and they take a while to deposit it. However, in some cases, the bank’s records do not include payments or deposits that are not yet deposited or cleared. In many cases, the bank’s calculations will be accurate and sufficient. Many people decide not to keep a checkbook register and instead rely on their bank to calculate their bank balance for them.

#Microsoft excel templates check register for tablet how to#

You can filter all transactions to include only those that are tax-deductible to ensure that you have included all those transactions when submitting your tax return.Ģ.1 How to Use the Check Register Template The Benefits of Keeping a Checkbook Ledger

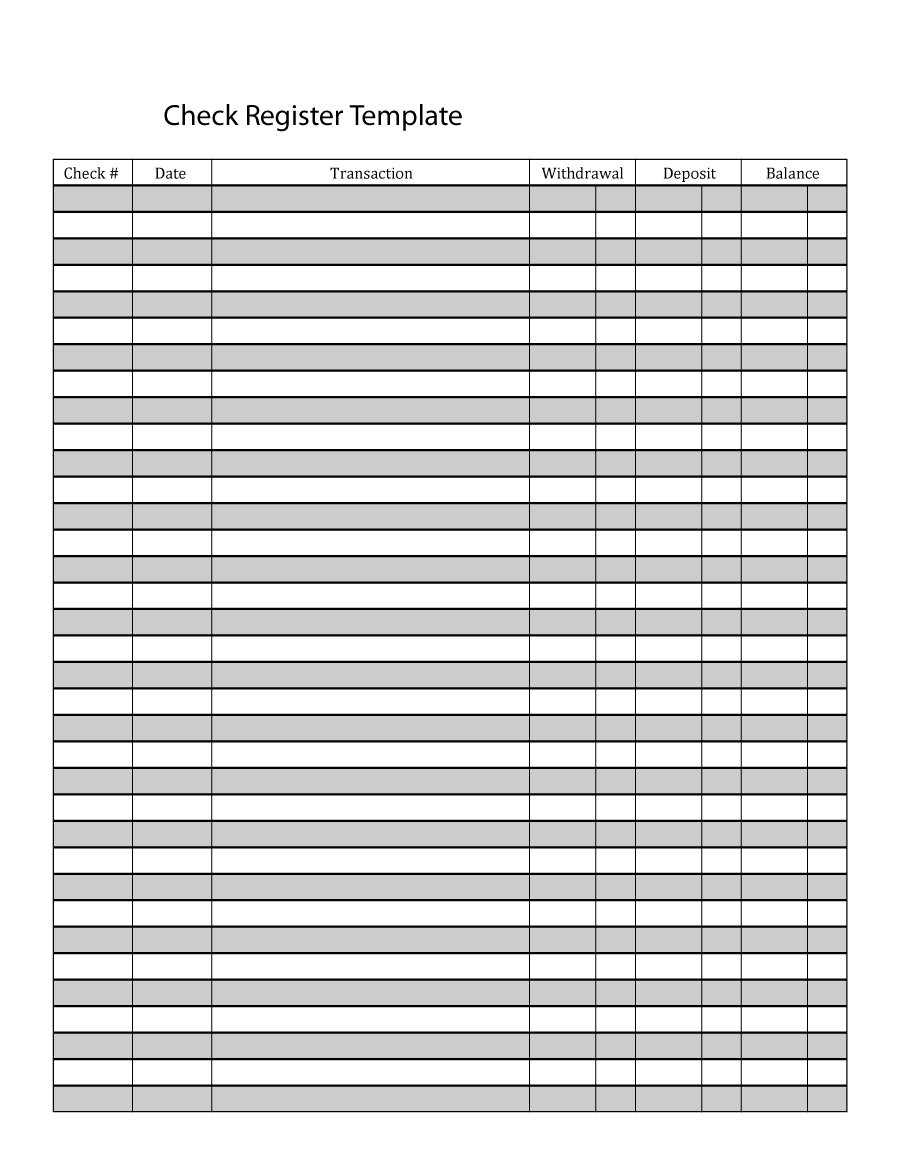

That way the column will be hidden but the formulas will not be affected. To hide a column, click on the top of the column (where the letters are) and right-click your mouse. The Excel spreadsheet has many formulas that you might delete if you delete a column. If you use the check register template Excel version then it is better to hide a column than to delete it. The free checkbook register is also editable so you can remove any of the fields if you don’t want to include them. It also checks whether the transaction is tax-deductible or not. The free printable check register template includes the following fields: the check number, the date it was issued, the payer or payee, transaction type, category, status (reconciled, cleared or not cleared).

It can also be used to record all outgoing and incoming checks issued or deposited. It records all payments and withdrawals during a specific period. Our free printable checkbook register template can be used to keep track of your bank balance at any given time.

0 kommentar(er)

0 kommentar(er)